In the realm of finance, seeking avenues for consistent returns while mitigating risks is an eternal quest. Traditional investments often fall short in turbulent markets, prompting investors to explore alternative options. One such avenue that has gained traction is the HFRX Absolute Return Index.

What is the HFRX Absolute Return Index?

It maintained by Hedge Fund Research Inc. (HFR), is a widely recognized benchmark for gauging the performance of hedge funds and alternative investment strategies. It serves as a yardstick for assessing the absolute return strategies adopted by hedge funds, aiming to generate positive returns regardless of market conditions.

Understanding Absolute Return Strategies

Unlike traditional investment approaches, which are often benchmarked against market indices like the S&P 500, absolute return strategies focus on generating positive returns irrespective of broader market movements. Hedge funds employing such strategies utilize diverse techniques, including long-short equity, event-driven, global macro, and managed futures, to achieve this objective.

Significance of the HFRX Absolute Return Index

The HFRX Absolute Return Index offers several advantages to investors:

- Diversification: It provides exposure to alternative investments beyond traditional asset classes like stocks and bonds, enhancing portfolio diversification.

- Risk Management: Absolute return strategies aim to deliver positive returns even during market downturns, potentially reducing overall portfolio volatility.

- Performance Benchmark: Investors and fund managers utilize the index to assess the performance of absolute return strategies against industry standards.

- Access to Hedge Fund Strategies: For investors unable to directly invest in hedge funds, the HFRX Absolute Return Index offers a proxy to track the performance of these strategies.

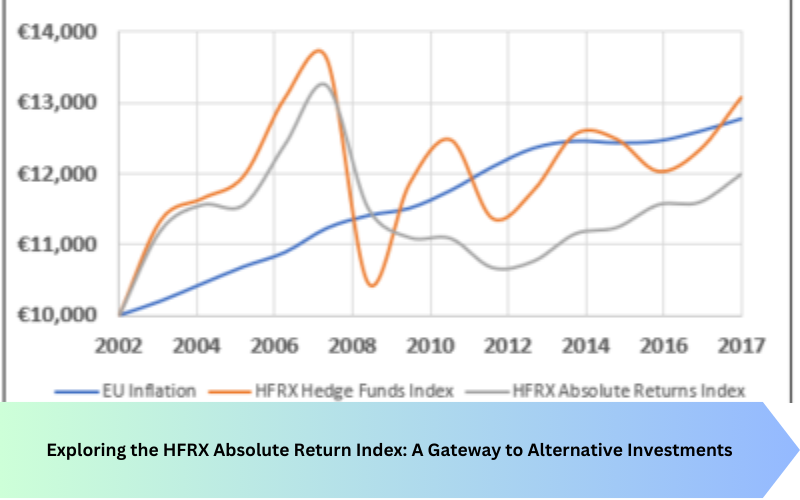

Performance and Track Record

The performance of the HFRX can vary over time, influenced by market conditions and the performance of underlying hedge fund strategies. Historical data indicates that the index has demonstrated resilience during periods of market volatility, showcasing its potential as a risk management tool in diversified portfolios.

Frequently Asked Questions (FAQs)

- How is the HFRX Absolute Return Index calculated?

- The index is calculated based on the performance of constituent hedge funds employing absolute return strategies. It employs a transparent methodology, incorporating various hedge fund data sources to ensure accuracy.

- Can individual investors directly invest in the HFRX ?

- No, It is a benchmark maintained by Hedge Fund Research Inc. Individual investors cannot directly invest in the index itself. However, they can access investment products, such as exchange-traded funds (ETFs) or mutual funds, that aim to replicate its performance.

- What are the typical fees associated with investments linked to the HFRX Absolute Return Index?

- Fees can vary depending on the investment vehicle utilized to access the index. Mutual funds and ETFs may charge management fees and expense ratios, while hedge funds implementing similar strategies may levy performance fees in addition to management fees.

- How does the HFRX perform compared to traditional market indices during market downturns?

- Absolute return strategies, as reflected in the HFRX , aim to deliver positive returns during market downturns. While traditional market indices may experience significant declines in such conditions, absolute return strategies seek to mitigate losses or even generate gains.

- What role does the HFRX play in portfolio construction?

- The index can serve as a valuable component in portfolio construction, especially for investors seeking diversification and risk management. By incorporating alternative investments represented by the index, investors can potentially enhance risk-adjusted returns and reduce overall portfolio volatility.

In conclusion, the HFRX Absolute Return Index offers investors a window into the realm of alternative investments, providing insights into the performance of hedge fund strategies designed to deliver positive returns across market cycles. Understanding its significance and incorporating it thoughtfully into investment strategies can potentially enhance portfolio resilience and returns in today’s dynamic financial landscape.

It is really a nice and useful piece of info. I am glad that you shared this helpful information with us. Please keep us up to date like this. Thanks for sharing.

Thanks for the strategies presented. One thing I should also believe is the fact that credit cards offering a 0 rate often lure consumers along with zero interest, instant endorsement and easy on the web balance transfers, nonetheless beware of the real factor that is going to void the 0 easy street annual percentage rate and also throw anybody out into the poor house quick.